-

Q: What types of visas are available for foreigners to stay in Thailand?

There are various forms of visas available to foreigners who wish to enter Thailand for study, business, investment, retirement and other purposes ranging from 90 days to 1 year multiple entry which include.

- Education visa when enrolled at registered education institution within Thailand

- Business visa when operating a business or employed

- Retirement visa for people aged 50 years or over and meet financial requirements

- Marriage visa for foreigners married to a Thai

- Thailand Elite Visa - a government led program offering memberships including 5 year visas and other privileges

Q: Is a leasehold apartment transferable?

Yes. Apartment leases may be transferred subject to the terms and conditions of the lease agreement. Generally, a small fee is payable. In addition, the new owner must agree to be bound by the terms and conditions contained in the original lease agreement.

Q: Is leasehold ownership secure?

Yes. Once the lease is registered at the Land Department, the owner’s rights to the apartment will be officially recognized.

Q: Should I appoint a lawyer to review the agreements?

Our agreements have been used for a number of years and have been reviewed by major international law firms. We have our own in-house legal team which will assist to clarify any questions you may have concerning the agreements. However, should you wish to obtain specific advice regarding the structuring of your investment, we recommend you consult with a professional legal and/or financial adviser.

Q: When will be the lease registration take place?

Approximately 90 days after full payment has been received and construction is complete. We will notify the owner of any documents and fees required for registration.

Q: What are the costs associated with the lease registration?

Lease registration fee and stamp duty (currently 1.1% of the apartment price) is payable to the Land Department upon registration of the lease. The cost of lease renewals will be borne by the lessee according to the contracts.

Note: that the rate above is imposed by the government authorities and may be subject to change when the lease registration takes place.

Q: What type of ownership is available?

Apartments are sold on a leasehold basis. Leases are registered with the Government (currently for a maximum period of 30 years as permitted by law) and are renewable.

-

Q: How long does construction take?

Generally it will take approximately 18-24 months to complete the building and landscaping from the date of commencement of construction.

Q: Is a warranty period offered?

Yes. A one year warranty is offered.

Q: How long does construction take?

Generally it will take approximately 24 months to complete the building and landscaping from the date of commencement of construction.

Q: Is a warranty period offered?

Yes. A one year warranty is offered.

-

Q: Is there a rental program available?

Yes, the apartments will be professionally managed. Investment and lifestyle rental options are available. The investment rental program - entitles owners to 30 days stay per year outside of the blackout dates (during the high/peak season periods) in order to maximize rental returns. Apartments in this rental program will be first priority for rental. The lifestyle rental program - entitles owners up to 90 days stay per year including blackout dates (during the high/peak season periods) in order to enjoy a balance between rental returns and lifestyle benefits. Apartments in this rental program will be second priority for rental.

Q: How does the rental pool program work?

The rental returns paid to owners will be calculated based upon a 40% share of room revenue under the same pool category (the other 60% being retained by the manager to cover operating expenses of the rental program). An example of how the return returns is determined is set out below:

No. of units under the same rental pool category Units 20 Total area of all units under the same rental pool category Sq M 840 Unit Size of Mr. A Sq M 42 Room nights available (20 units * 365 days) Days 7,300 Occupancy % 70% Room nights occupied (7,300 days * 70%) Days 5,110 Average Room Rate THB 3,000 Room Revenue (excluding service charge and taxes) THB 15,330,000 Revenue Share to all Owners @ 40% THB 6,132,000 Less Reserve Fund Contribution @ 3% of Room Revenue *** THB (459,900) Revenue Share to all Owners under this pool THB 5,672,100 Revenue Share to Owner – Mr. A – before withholding tax (5,672,100 / 840 sqm * 42 sqm) THB 283,605 Note: the operation of the rental program is at the discretion of the manager and may be subject to change. The above example is indicative only of how the rental returns will be determined and may not reflect the actual returns achieved.

*** A reserve fund contribution is at 3% on year 1, 4% on year 2, and 5% on year 3 and onwards.

Q: What rental yield can I expect?

Since the apartments are in a prime location and are professionally managed, there is potential for good rental returns and capital appreciation.

The table below, indicates the potential gross rental yields based upon the assumptions shown:

1. Assumptions No. of units under the same rental pool 20 Total area of all units under the same rental pool category 840 sqm Unit size of Mr. A 42 sqm Occupancy % 70% 60% Average Daily Rate (THB) 5,000 4,000 3,000 5,000 4,000 3,000 2. Revenue share Total Room Revenue 25,550,000 20,440,000 15,330,000 21,900,000 17,520,000 13,140,000 Revenue Share to All Owners @ 40% 10,220,000 8,176,000 6,132,000 8,760,000 7,008,000 5,256,000 Less Reserve Fund @3% (766,500) (613,200) (459,900) (657,000) (525,600) (394,200) Net Revenue Share to All Owners 9,453,500 7,562,800 5,672,100 8,103,000 6,482,400 4,861,800 Net Revenue Share to Mr. A 472,675 378,140 283,605 405,150 324,120 243,090 3. Gross Rental Yield Investment @ THB 6 million 7.9% 6.3% 4.7% 6.8% 5.4% 4.1% Investment @ THB 7 million 6.8% 5.4% 4.1% 5.8% 4.6% 3.5% Investment @ THB 8 million 5.9% 4.7% 3.5% 5.1% 4.1% 3.0% The figures above are for illustrative purposes only and should not be relied upon as forming a representation or guarantee as to the actual returns which may differ significantly from the above.

Q: How is my rental return paid?

Owners will be paid rental returns direct to their nominated bank on a quarterly basis.

Q: What are the taxes levied on the rental program that an owner will be subject to?

All owners are subject to personal / corporate income tax in accordance with the Thai Revenue Code. Rental distributions made to non-resident (foreign) owners and Thai tax resident owners are subject to 15% and 5% withholding tax respectively. Such withholding taxes will be treated as a tax credit for the aforesaid income tax.

Note: applicable tax rates are current at the date of issue of this FAQ and may be subject to changes. The unit owner shall be responsible for any income and any other taxes, duties and fees of whatever nature which may be levied by relevant authorities on the unit in connection with the rental. All unit owners are advised to seek their own tax advice in this regard.

Q: Can I rent my apartment out on my own?

No. All rentals must be conducted through the manager.

Q: Can I choose my own furniture?

No. A standard furniture package will be required in all apartments.

Q: Can I stay at any time?

Yes, subject to the terms and conditions imposed under the rental program selected. Blackout dates apply for stays in the investment rental program. However, all reservations by owners for their stays are subject to availability. However, the manager will endeavor to provide a similar apartment for your stay if your apartment is unavailable.

Q: What are the blackout dates?

High season periods such as Christmas, New Year, Chinese New Year and Easter.

Q: Why are there blackout dates?

High season periods are the busiest time of the year. It is during these times when demand is highest and the best opportunity exists to yield maximum rental returns.

Q: How much advance notice is required for my stay?

Owners should provide as much notice as possible as apartments may be pre-booked with third party guests, particularly for stays during high season periods.

Q: Can my friends use my owner’s entitlement?

Yes, subject to terms and conditions of the rental agreement (e.g. owners’ guests may be required to be pre-registered with the manager).

Q: Can I book more than one apartment during the same period?

No.

Q: What utilities do I have to pay?

For apartments being rented out, these costs will be covered by the revenue share retained by the manager. For apartments being occupied by owners, utilities will be based upon the consumption / costs incurred.

Q: Is there a rental program available?

Yes, the apartments will be professionally managed. Investment and lifestyle rental options are available.

The investment rental program - entitles owners to 30 days stay per year outside of the blackout dates (during the high/peak season periods) in order to maximize rental returns. Apartments in this rental program will be first priority for rental.

The lifestyle rental program - entitles owners up to 90 days stay per year including blackout dates (during the high/peak season periods) in order to enjoy a balance between rental returns and lifestyle benefits. Apartments in this rental program will be second priority for rental.

Q: What are the taxes levied on the rental program that an owner will be subject to?

Rental distributions made to non-resident (foreign) owners are subject to 15% withholding tax. Rental earned by Thai tax residents are subject to 5% withholding tax.

Note: applicable tax rates are current at the date of issue of this FAQ and may be subject to changes.

Q: How does the rental program work?

The rental returns paid to owners will be calculated based upon a 40% share of room revenue (the other 60% being retained by the manager to cover operating expenses of the rental program). In addition, 3% of room revenue is held in a reserve fund for future refurbishment costs.

An example of how the return returns will determined is set out below:

Days Available 365 Days Sold 255 Occupancy % 70% Average Daily Rate (Baht) 3,000 Room Revenue (Baht) 765,000 Revenue Share to Owner @ 40% (Baht) – Gross 306,000 Less Reserve Fund Contribution @ 3% of Revenue (22,950) Revenue Share to Owner – Before Withholding Tax 283,050 Note: the operation of the rental program is at the discretion of the manager and may be subject to change. The above example is indicative only of how the rental returns will be determined and may not reflect the actual returns achieved.

Q: What rental yield can I expect?

Since the apartments are in a prime location and are professionally managed, there is potential for good rental returns and capital appreciation.

The table below, indicates the potential gross rental yields based upon the assumptions shown:

1. Assumptions Occupancy % 70% 60% Average Daily Rate (THB) 4,000 3,000 2,000 4,000 3,000 2,000 2. Revenue share Gross Revenue (THB) 1,022,000 766,500 511,000 876,000 657,000 438,000 Owners share @40% (THB) 408,800 306,600 204,400 350,440 262,800 175,200 3. Gross Rental Yield Investment @ THB 5 million 8.2% 6.1% 4.1% 7.0% 5.3% 3.5% Investment @ THB 6 million 6.8% 5.1% 3.4% 5.8% 4.4% 2.9% Investment @ THB 7 million 5.8% 4.4% 2.9% 5.0% 3.8% 2.5% The figures above are for illustrative purposes only and should not be relied upon as forming a representation or guarantee as to the actual returns which may differ significantly from the above.

Q: How is my rental return paid?

Owners will be paid rental returns direct to their nominated bank on a quarterly basis.

Q: Can I rent my apartment out on my own?

No. All rentals must be conducted through the manager.

Q: Can I stay at any time?

Yes, subject to the terms and conditions imposed under the rental program selected. Blackout dates apply for stays in the investment rental program. However, all reservations by owners for their stays are subject to availability. However, the manager will endeavor to provide a similar apartment for your stay if your apartment is unavailable.

Q: What are the blackout dates?

High season periods such as Christmas, New Year, Chinese New Year and Easter.

Q: Why are there blackout dates?

High season periods are the busiest time of the year. It is during these times when demand is highest and the best opportunity exists to yield maximum rental returns.

Q: How much advance notice is required for my stay?

Owners should provide as much notice as possible as apartments may be pre-booked with third party guests, particularly for stays during high season periods.

Q: Can I choose my own furniture?

No. A standard furniture package will be required in all apartments.

Q: Can my friends use my owner’s entitlement?

Yes, subject to terms and conditions of the rental agreement (e.g. owners’ guests may be required to be pre-registered with the manager).

Q: What utilities do I have to pay?

For apartments being rented out, these costs will be covered by the revenue share retained by the manager. For apartments being occupied by owners, utilities will be based upon the consumption / costs incurred.

Q: Can I book more than one apartment during the same period?

No.

-

Q: What common facilities and services are provided?

The common areas within the project will be professionally managed and services will include maintenance, pest control, gardening, pool cleaning, security, etc. A common area fee will be charged to all owners for services provided in respect of common property based upon the costs incurred. For apartments being rented out, standard hotel type services costs will be covered by the revenue share retained by the manager. For apartments being occupied by owners, a schedule of rates will apply for various services offered.

Q: What are the estimated common area charges?

These will be charged based upon costs incurred.

Q: What are the estimated common area charges?

These will be charged based upon costs incurred.

Q: What common facilities and services are provided?

The common areas within the project will be professionally managed and services will include maintenance, pest control, gardening, pool cleaning, security, etc. A common area fee will be charged to all owners for services provided in respect of common property based upon the costs incurred. For apartments being rented out, standard hotel type services costs will be covered by the revenue share retained by the manager. For apartments being occupied by owners, a schedule of rates will apply for various services offered.

Q: What privileges will I receive as an owner?

Owners will receive a ‘Sanctuary Club’ card which entitles holders to discounts and privileges at all Banyan Tree, Angsana and Laguna Resorts worldwide.

- 30% discount on best available rates for hotel accommodation

- 25% discount on food and beverage

- 30% discount on golf green fees

- 20% discount on a-la-carte spa menu

- 15% discount on gallery merchandise

- 15% discount on in-house tours

- 15% discount on laundry

- 10% discount airport and ferry terminal transfers

- Priority wait-list on reservations

- Early check-in / late check-out

**Terms and conditions apply.

Owners can exchange part of their annual use entitlement for free stays at participating properties within the global network.Q: What privileges will I receive as an owner?

Owners will receive a ‘Sanctuary Club’ card which entitles holders to discounts and privileges at all Banyan Tree, Angsana and Laguna Resorts worldwide.

- 30% discount on best available rates for hotel accommodation

- 25% discount on food and beverage

- 20% discount on golf green fees

- 20% discount on a-la-carte spa menu

- 15% discount on gallery merchandise

- 15% discount on in-house tours

- 15% discount on laundry

- 10% discount airport and ferry terminal transfers

- Priority wait-list on reservations

- Early check-in / late check-out

**Terms and conditions apply.

Owners can exchange part of their annual use entitlement for free stays at participating properties within the global network.

Q: What are the payment plans available?

There are 2 options available:

Option 1: 100% payment upon purchase / during construction

100% payment upon purchase for already completed properties. Progressive payments for properties under construction as per the table below.

Notes:Construction Payment Term Of Selling Price 1st Payment upon signing contract 20% 2nd Payment when construction is 25% complete1 20% 3rd Payment when construction is 50% complete2 20% 4th Payment when construction is 75% complete3 20% 5th Payment upon completion of construction 20% Total 100% - Concrete structure substantially completed

- Roof, brickwork and rendering substantially completed

- Electrical conduits and pipe work substantially completed

Option 2: 50% payment upon purchase / during construction with 50% deferred payment over 1, 3 or 5 years

50% payment upon purchase for already completed properties. Progressive payments for properties under construction (50% during construction / 50% post construction) as per the table below.

Note:Deferred Payment Plan Of Selling Price 1st Payment upon signing contract 20% 2nd Payment when construction is 50% complete1 10% 3rd Payment when construction is 75% complete2 10% 4th Payment upon completion of construction3 10% Post construction payments4 50% Financing Options Interest Rate 1 Year (12 monthly installments) 3% 3 Year (36 monthly installments) 5% 5 Year (60 monthly installments) 7% - Concrete structure substantially completed

- Roof, brickwork and rendering substantially completed

- Electrical conduits and pipe work substantially completed

- See table below

Price Reservation Deposit Construction Completion Payment 50% (Minus Deposit) Remaining Post Finance 50% Monthly Installment 1 Year (3%) 3 Year (5%) 5 Year (7%) 5,500,000 100,000 2,650,000 2,750,000 232,908 82,420 54,453 6,000,000 100,000 2,900,000 3,000,000 254,081 89,913 59,404 6,500,000 100,000 3,150,000 3,250,000 275,255 97,405 64,354 7,000,000 100,000 3,400,000 3,500,000 296,428 104,898 69,304 7,500,000 100,000 3,650,000 3,750,000 317,601 112,391 74,254 8,000,000 100,000 3,900,000 4,000,000 338,775 119,884 79,205 8,500,000 100,000 4,150,000 4,250,000 359,948 127,376 84,155 9,000,000 100,000 4,400,000 4,500,000 381,122 134,869 89,105 9,500,000 100,000 4,650,000 4,750,000 402,295 142,362 94,056 10,000,000 100,000 4,900,000 5,000,000 423,468 149,854 99,006 Notes: 1. All amounts are stated in Thai Baht. 2. The above table sets out the estimated payments required under the respective payment plans for selling prices between THB 5,500,000-10,000,000. 3. The estimated payments are indicative only and the developer / seller does not accept any responsibility or liability whatsoever for any inaccuracies or omissions. 4. Payment terms are subject to change without notice.

Q: What are the payment plans available?

There are 2 options available:

Option 1: 100% payment upon purchase / during construction

100% payment upon purchase for already completed properties. Progressive payments for properties under construction as per the table below.

Notes:Construction Payment Term Of Selling Price 1st Payment upon signing contract 20% 2nd Payment when construction is 25% complete1 20% 3rd Payment when construction is 50% complete2 20% 4th Payment when construction is 75% complete3 20% 5th Payment upon completion of construction 20% Total 100% - Concrete structure substantially completed

- Roof, brickwork and rendering substantially completed

- Electrical conduits and pipe work substantially completed

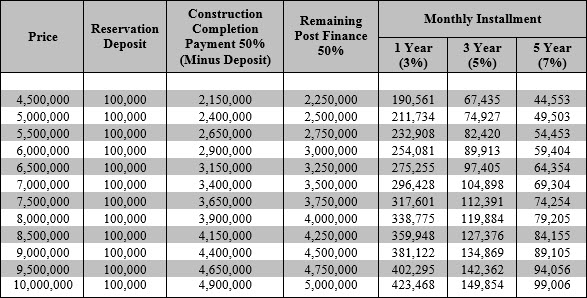

Option 2: 50% payment upon purchase / during construction with 50% deferred payment over 1, 3 or 5 years

50% payment upon purchase for already completed properties. Progressive payments for properties under construction (50% during construction / 50% post construction) as per the table below.Deferred Payment Plan Of Selling Price 1st Payment upon signing contract 20% 2nd Payment when construction is 50% complete1 10% 3rd Payment when construction is 75% complete2 10% 4th Payment upon completion of construction3 10% Post construction payments4 50%

Notes:Financing Options Interest Rate 1 Year (12 monthly installments) 3% 3 Year (36 monthly installments) 5% 5 Year (60 monthly installments) 7% - Concrete structure substantially completed

- Roof, brickwork and rendering substantially completed

- Electrical conduits and pipe work substantially completed

- See table below

Notes:

Notes:

- All amounts are stated in Thai Baht.

- The above table sets out the estimated payments required under the respective payment plans for selling prices between THB 4,500,000-10,000,000.

- The estimated payments are indicative only and the developer / seller does not accept any responsibility or liability whatsoever for any inaccuracies or omissions.

- One year deferred plan is 12 equal monthly installments (3% interest applies).

- Three year deferred plan is 36 equal monthly installments (5% interest applies).

- Five year deferred plan is 60 equal monthly installments (7% interest applies).

- Payment terms are subject to change without notice.